Chances are that if you’re in Myanmar (or will be arriving here very soon), you’ll join a Facebook Marketplace to make your life a little bit easier. From flat leases, to furniture and pet products, the uncomplicated but effective service is becoming increasingly popular among connected Myanmar people. But this simple version of e-commerce is also quickly giving way to larger, dedicated websites that would rival international equivalents like Alibaba and Amazon.

With growing financial infrastructure and more international payment systems (like Visa) laying down roots in Myanmar, e-commerce will grow in time. It will mean more options for local consumers and merchants, as well as increased competition as products vie for attention and market share. Here’s a brief history and the current status of e-commerce in Myanmar, as well as some challenges we foresee ahead.

The Beginnings

As mentioned, the most common Myanmar online shopping sites (both by number and by amount of users) are on Facebook. With its Facebook Marketplace feature, the social media site essentially turns into a newspaper-style classified advertisement service.

Users can set up the Marketplaces themselves, just like regular Facebook Groups. Often they focus on specific product types (housing and furniture) or geographic regions, and sometimes even specific areas of a city. The interface is simple yet effective, allowing users to indicate a price and location for their items, as well as upload a few photos. Of course, just like traditional classified ads, users are tasked with negotiating their own pickup and delivery, and cash on arrival is the only form of payment accepted.

But now, as mobile networks continue to strengthen across Myanmar and smartphone usage tops 80%, investors and businesspeople are looking to continue transforming business in Myanmar, moving e-commerce beyond Facebook.

New Sites

Myanmar’s most popular online shopping site by far (besides Facebook Marketplaces) is shop.com.mm. Offering products from iPhones, to flip flops and diapers, it’s truly a one stop shop and averages more than 500,000 unique visitors per month. Though this may seem modest in a country of 53 million people, with just 18 million people in urban areas across the country (under 7 million of whom are in Mandalay and Yangon) and with nearly 95% of the population unbanked, roadblocks to e-commerce certainly exist.

To attract customers and gain their confidence, shop.com.mm is mirroring its more western counterparts like Amazon by offering a 7-day return policy and a warranty-like service for products that become damaged or defective over time — both of which are typically not provided by traditional Myanmar merchants. With an overwhelmingly mobile-first population in Myanmar, the site has also launched apps for both Android and iOS devices to accommodate shopper habits. To keep growing, shop.com.mm plans to expand its list of vendors, and introduce international merchants into the mix.

Challenges

Moving forward, e-commerce development is facing a few challenges. The first is the limited capabilities of payment processing in Myanmar. With a mostly cash economy, the proper infrastructure to process electronic payments will need to be developed and Myanmar people will have to get used to the idea of paying for goods electronically, and before they are delivered.

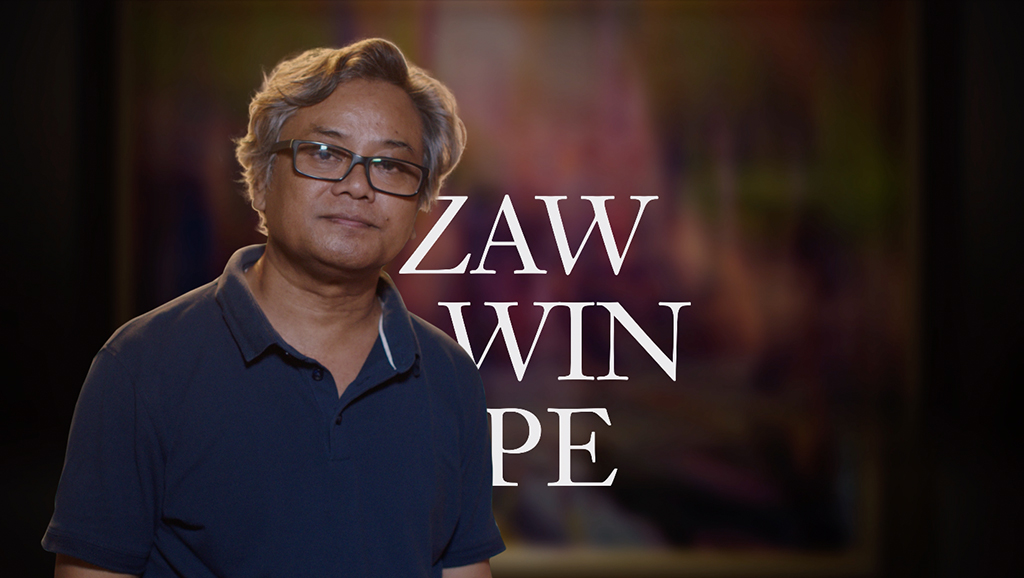

As part of a massive consumer and merchant education campaign for our client Visa, we shot and produced short vignette videos not only about the benefits of shopping with Visa, but also about the security and benefits of a cashless transaction. Moving in the right direction, shop.com.mm recently launched an online payment portal to accept credit and debit cards from Visa, Mastercard and MPU. When customers choose to pay ahead of delivery with a card, they receive an extra 5% discount on select purchases. But there is still a long way to go.

Other means of electronic payment are also attempting to fill this “fintech gap.” All three dominant telecom companies (Ooredoo, MTP, and Telenor) have created their own digital finance ecosystems in Myanmar, along with companies like OK Dollar and Red Dot Network. In the long run, the hope is that these systems will not only make e-commerce easier, but will also give underserved rural populations access to financial services.

Finally, and in a more utilitarian sense, the county will also need to see faster and more affordable internet and more comprehensive shipping and delivery services. Though international shipping companies like DHL have made their way to Myanmar, most of the deliveries are done from door-to-door in the country’s largest cities, and completed on motorcycle or bike.